What is decentralized exchange?

Decentralized Exchange (DEX) is a platform that is not dependent on third parties to save you money, all automatic and direct transactions between users (peer-to-peer network). In other words, DEX - decentralized exchange gives users full control over funds and transactions, excluding intermediaries, to avoid the risk of security problems, hackers, fraud. In addition, the introduction of taxation or control of funds from decentralized exchanges is very difficult. Based on this, MainFinex was created to create a reliable platform for trading digital assets!

What is the difference between decentralized and centralized floors?

The right to control funds

Exchange users focus on making deposits on the exchange to facilitate trading. This fund is controlled by an intermediary trading service. This means that the order book, as well as storage rights, are in the hands of a centralized platform service.

In a decentralized digital currency exchange platform, users trade directly with other traders without a central server. There is no centralized service having a book of commands and the rights of prisoners. Because of this, money is controlled by users and participants of this platform.

anonymity

Several centralized exchanges allow anonymous trading accounts on their platform. However, new government regulations in recent months have led to strict compliance with KYC and AML laws . It is difficult to trade anonymously with a centralized exchange of digital currencies. Conversely, decentralized exchange is a place where everyone can remain anonymous.

identification

Centralized exchange users depend on the platform to authenticate and authorize their transactions. On the one hand, this platform is a third-party intermediary that provides reliable crypto exchange services.

With decentralized exchanges, we do not need to rely on intermediaries. Thanks to smart contracts and several implementations of the Blockchain protocol, the entire system is built to provide authentication and authorization of unreliable cryptocurrency exchange transactions.

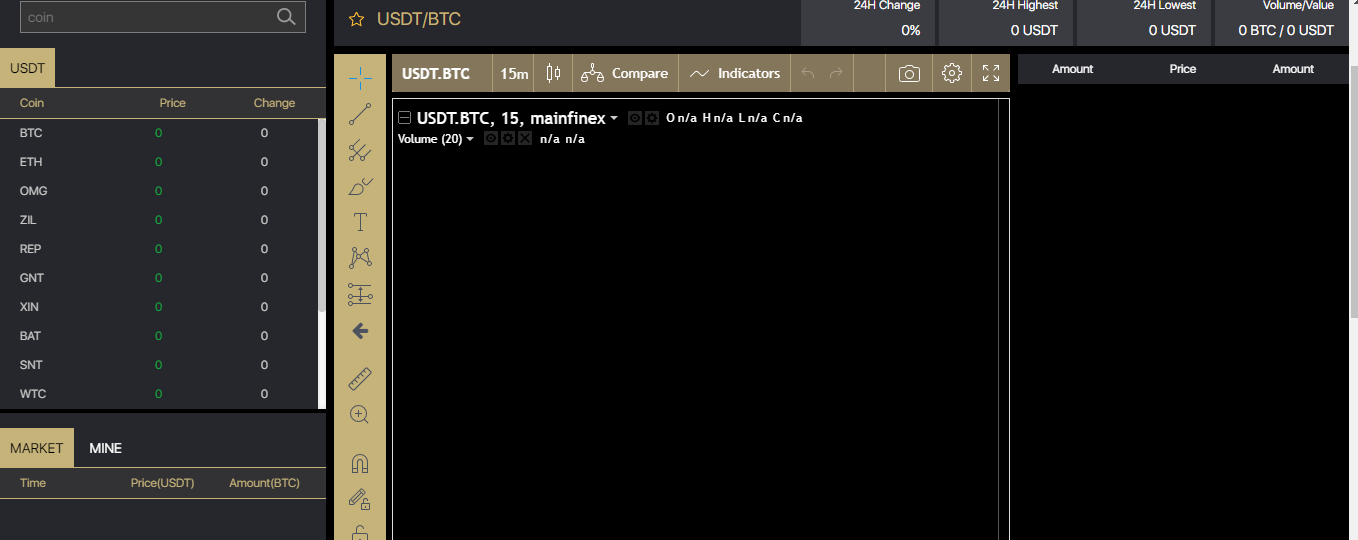

Decentralized Exchange Rates, MainFinex

Transactions are processed faster and cheaper.

More difficult to attack

The decentralized exchange MainFinex does not have user tools, and no organization intervenes in the process, so this exchange is difficult to crack. Meanwhile, history has recorded many attacks on centralized exchanges, such as Bitfinex , Bittrex .

Perfect integration with secure hardware wallet

This is the main advantage of the MainFinex decentralized exchange . Many decentralized exchanges offer unlimited integration with popular hardware wallets such as Ledger Nano S or Trezor to provide much more secure trading.

Users can send coins directly from their hardware wallets to smart contracts from many decentralized exchanges. Thanks to a centralized exchange, users cannot manually fill in private keys to transfer coins from a hardware wallet to an exchange. Because if you do this, most likely they will be cheated or track the keyboard.

Funds are fully user controlled

MainFinex is a decentralized exchange that is owned and controlled by all parties, so no centralized company has the right to hold customer funds. Money control is always in the hands of users thanks to the network structure of colleagues. Transactions occur between parties on the network using smart contracts that can only be controlled using the private key of the parties involved. Users constantly monitor their private keys and capital through decentralized exchanges.

Some weaknesses of MainFinex decentralized floors

Only supports a few platforms

Currently, Ethereum is the most popular platform for decentralized exchange, with several ERC-20 tokens that support trading. In the future, several other major platforms, such as NEO, will also be supported by decentralized exchanges.

More difficult to use

That's why exchanges such as Binance or Huobi are popular simply because they are easy to use. Many smart contracts should be used for decentralized exchanges, which can be a headache for users, even for those who are familiar with cryptocurrency technologies.

Centralized exchange also has a simple user interface that is visually organized and easier to launch than decentralized exchange.

Lack of strong features and functions

Most decentralized exchanges only support a few basic trading functions. Features and tools of the trade are deeper, such as Margin trading , stop loss, etc. Often lost from decentralized exchanges. This is probably the main reason why decentralized exchange is still not popular in the cryptocurrency market.

conclusion

Above is the article “What is MainFinex Decentralized Exchange? What is the difference between centralized and decentralized exchange? We hope to convey to readers the most useful information about this type of exchange. If you have questions, leave a comment below. I will support you.

PRECISE INFORMATION

Website: https://mainfinex.com/index.html

Telegram: https://t.me/mainfinex

Twitter: https://twitter.com/mainfinex

WHITEPAPER: https://mainfinex.com/whitepaper.pdf

Username : Ozie94

ETH : 0xDa2F65ea0ED1948576694e44b54637ebeCA22576

No comments:

Post a Comment