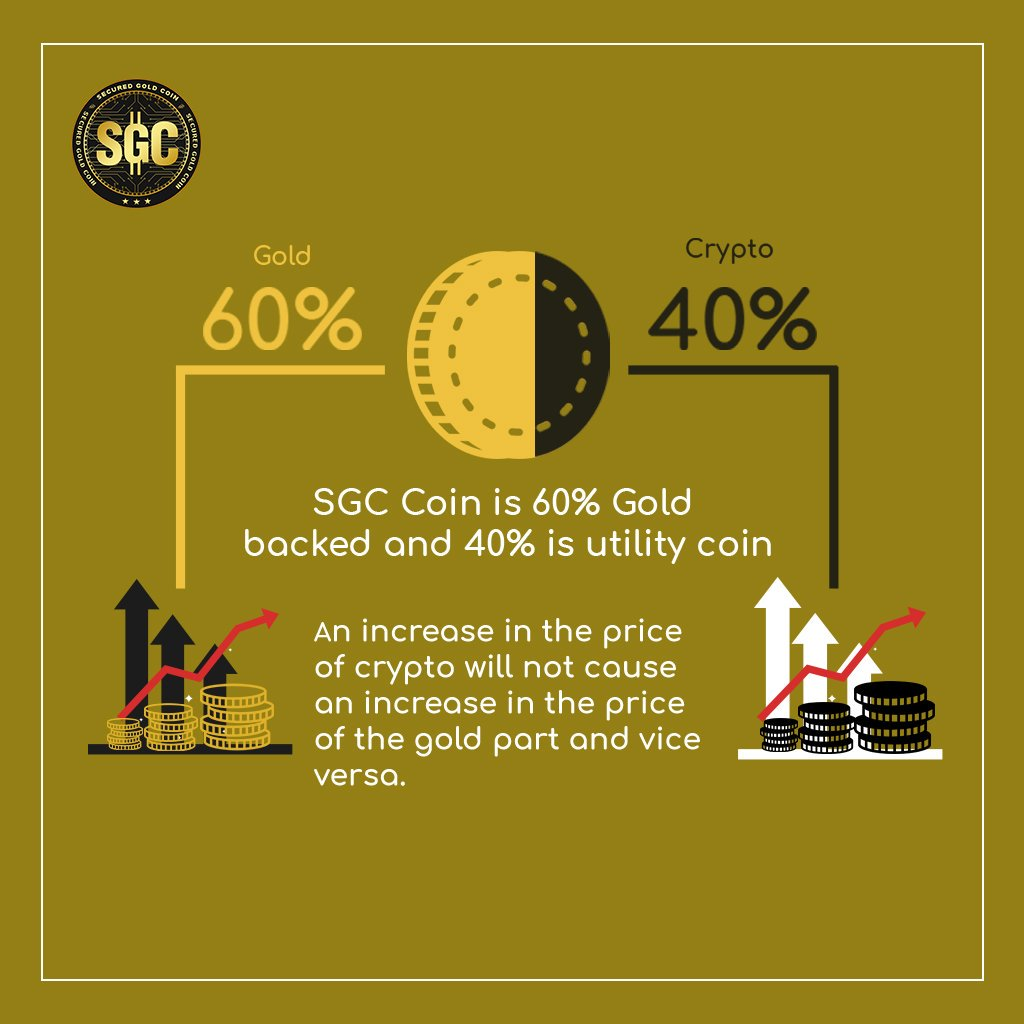

The world economy is littered with miscellaneous cryptocurrencies that fail to deliver on their promises and fiat currencies that are controlled by governments for the benefit of themselves. In response to this growing problem, Secured Gold Coin Pty Limited; based in Australia, has developed Secured Gold Coin (SGC coin), a cryptocurrency that is initially released 60 percent gold-backed coin, is completely decentralized, and is free from manipulation by any single entity. The initial released 60% gold backed coin means that the quantity of gold backing the coin at the time of initial release is not affected by the price volatility of SGC coin or Gold in the future. SGC coins are unique because they have been created specifically for global usage with a virtual wallet that eliminates the need to carry physical cash.

The advantages of SGC blockchain based software contracts (smart contracts) enable SGC coins to be decentralized, secure, and transparent for all users. SGC will initially employ standard digital coins that are exchangeable for specified cryptocurrencies and fiat currencies. SGC holders will have the ability to buy and sell their coins following the official listing on the public cryptocurrency exchange.

Key Objectives

We are focused on achieving three critical objectives. We believe the achievement of these objectives are congruent with the best interests of SGC users and will provide intrinsic value to the communities that embrace SGC coins.

- First objective

- Secondly

- Finally

Most of the companies offering gold-backed digital currencies are reluctant to store any physical gold for avoiding the headache of security or any other risk involved. Moreover, they do not want to be dependent on any third party to get involved in their systems to ensure the security of their gold reserves. Secured Gold Coin with its partners, is ready to face the challenges as they store physical gold in a secure vault. Thus, when you become the user of SGC coins, the physical gold equivalent to 60% part of your initially released SGC coin will be attached to your wallet address and displayed on the SGC Blockchain Explorer. So whenever a user buys SGC coins, a gold certificate is attached to the wallet address of the user. Once the certificate is issued, the wallet address shall remain the same even if its traded to other addresses. Which means that the price and quantity of gold mentioned on the certificate against the SGC coin being purchased, will remain the same and cannot change on the re-selling, valuation, or devaluation of the same coin.

Goals

Other than our key objective of providing a universal cryptocurrency for the users to trade hybrid digital assets (asset + utility), and make payments, we are looking forward towards the goals that will lead the SGC coin to become global. With our SGC PAY Debit Card integration, the SGC coin will be adopted as mainstream. The SGC PAY will open new ways of spending and sending SGC coins. The SGC Online Shop aims to provide ways of utilization for our hybrid (asset + utility) coin. And finally listing our coin on global exchanges will make trading easier for the users.

- We’ve established a fundamental association with MasterCard, Visa Card, and Union Pay

- SGC PAY debit card integration

- SGC PAY

- List SGC coin on exchange

- SGC Online Shop

- SGC Crypto Bank

- Achieve at least a 51% utilization rate in the retail based market by 2024.

In the banking system, there are several monetary issues specifically in the cross-border payments settlement which is the base of our businesses today. The system has many inherent flaws and challenges that we need to overcome. Many of our businesses are struggling because of the drawbacks of our conventional banking system. The centralized banking system has been the root of the challenges. Banks being controlled by a central authority who demands the users and businesses to be dependent on it. So, even if it is a cross-border payment or even a transaction of one’s money from the banks, one is dependent on the banks to perform the transaction which also charges heavy fees in turn. These high fees in itself are not favourable for businesses as they gallop a part of the company’s profit.

SOLUTIONS

SGC Coin is not just an asset backed cryptocoin rather it works as a hybrid coin. On one hand, its initial release is 60% backed by physical gold on the other it can be used as a utility coin on our E-commerce platform, be traded on exchanges or can even be integrated with our SGC PAY Debit Card for further payment options. To make the currency available everywhere you go, SGC has introduced various methods for SGC usability. These options make SGC available for you as and when required according to your need and choice. From making payments on online e-commerce platforms to paying on point of sale with SGC PAY Debit Card, from trading to sending and receiving of money from mobile application SGC coin has got all options to make the SGC user content.

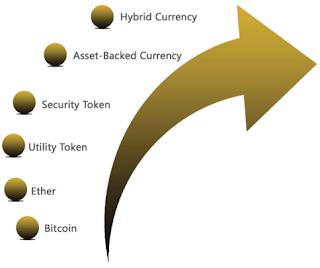

To overcome the issues of traditional investments and stock exchanges, cryptocurrencies were introduced. A cryptocurrency is a digital asset designed to work as a medium of exchange using cryptography to secure transactions, to control the creation of additional units, and to verify the transfer of assets. Cryptocurrencies are classified as a subset of digital currencies and are also classified as a subset of alternative currencies and virtual currencies. Initially, they seemed to solve the problems faced in the traditional investment procedures but they have there inherent limitations and challenges as well. Over a period of time, cryptocurrencies are evolved in the following manner.

Currency Coins

Currency tokens/coins like BTC, ETH, and LTC were made just as a replacement for fiat money. They are used as a payment method and can be traded for real fiat. users have used them as investments owing to the trends of various cryptocurrencies showing an increase in valuation Bitcoin being on the top. But these currency coins specifically bitcoin have been incredibly volatile since its inception. The price volatility of bitcoin can be visualized from the graph below where the bitcoin index value for the end of October 2016 was 679 U.S. dollars reaching to 19,783.06 U.S. dollars on December 17, 2017, in just a year.

Utility Coins

Utility tokens/coins came into being after the evolution of currency coins. These coins are mostly used in ICO’s and expect an increase in value to the users by providing practical utilities to the users and platform users. The valuation of these coins is dependent on supply and demand cycles and are thus vulnerable to outside stimuli. One cannot guarantee a future profit while investing in a utility coin. Here’s a plot of 118 coins that have been floated onto the markets that have achieved at least an average of $250,000 market cap in any one year of their existence. The graph clearly depicts how the value of most of the coins has fallen

Asset-Backed Hybrid Coins

After the introduction of Bitcoin and Ethereum, there has been constant research on improving the cryptocurrency market. The cryptocurrencies have kept on improving from a basic investment based tradable currencies to utility coins, security coins, asset-backed coins, and now the hybrid coins.

coins are the invention for the future. These are the blockchain coins backed by real valuable assets mostly at 1:1 ratio but can be changed depending on the need of a platform. Backing a coin with the real-world tangible or intangible object of economic value makes the worth of coin exactly the value they are backed for. Thus, there is never the risk of losing digital assets until or unless the worth of asset falls.

SGC Hybrid Coins

Tokenizing assets has become a very advantageous source of making investments as it is turning the world into a massive stock market. There are some benefits of asset-backed coins given below:

- Liquidity enhancement

- Instant traceability via exchanges

- Diversification of risk

- Ownership transference without restrictions

- A secure and cost-efficient way of getting ownership

- Referral incentivization for influencers

- Low administrative costs

- Availability of assets’ ownership history

- Security

- Stability

- Usability

As cryptocurrency has not been accepted everywhere till now, therefore it is a very useful way of spending SGC coins using your SGC PAY Debit Card as it makes SGC coins usable everywhere.

SGC BLOCKCHAIN

The blockchain is a decentralized distributed ledger that allows secure, fast, and cost-efficient transactions to be made in no time. With blockchain, the data stored cannot be changed once entered which makes it an immutable distributed ledger. Being a decentralized and distributed architecture, blockchain allows everyone on the network, to take part in the transaction validation mechanism called consensus making it a highly trustworthy, secure, anti-fraudulent, and durable for data storage.

People often question how digital currencies can have value without being backed by any tangible asset. The answer is: they are more durable, divisible, fungible, scarce, and transferable than fiat currencies. But there are several digital currencies backed by tangible asset known as asset-backed tokens/coins. The most popular of asset-backed digital currencies are Gold-backed coins that have physical gold to sustain their value. The potential asset-backed coin market size is much bigger and encompasses different assets such as oil, gold, fiat currencies, diamonds, real estate, shares of companies, artwork, intellectual property etc.

Security Tokens

Security tokens and Security Token Offerings (STO’s) are the new things in the market. They were introduced to tackle the problem of currency tokens and utility tokens. Security tokens offer dividends from the company’s profit to the users. They work the same as the stock exchange shares. Security tokens are however more secure than utility currencies but the problem of losing all the investment in case of loss is still there. There is just a need for a digital asset that can assure users of some guaranteed value to remove the insecurities. The predicted hype cycle also foresee a fall in the liquidity of the security tokens in the upcoming years.

SGC Wallet

Secured Gold Coin Pty Limited has developed its crypto wallet that will facilitate the users to make transactions and view their information on transactions made by themselves. SGC in its aim to provide users with ease with as many options as possible, has developed the SGC Wallet across multiple platforms including SGC Web Wallet, SGC Mobile Wallet (Android, iPhone), and SGC Desktop Wallet (Windows, Linux, MAC). Our SGC wallet enables the user to,

- Create New Account:

- Import Accounts:

- Passphrase and Pattern Security:

- Check Account Balance:

- Check Overall Balance of Accounts in Wallet:

- Check Transactions:

- Check Transaction History:

- Send SGC Coins:

- Integrate SGC PAY Debit Card:

- Deploy Contract:

Coin at Time Of Initial Release

- Total Price Per Coin (USD) : $1

- Utility Part Price Per Coin (USD – 40%) : $0.4

- Gold Part Price Per Coin (USD – 60%) : 0.6

- Current Gold Price Per Gram (USD) : $40

- Gold Per Coin (Grams) : 0.015 gm

- Total Price Per Coin (USD) : $10

- Utility Part Price Per Coin (USD – 40%) : $8.8

- Gold Part Price Per Coin (USD – 60%) : $1.2

- Current Gold Price Per Gram (USD) : $80

- Gold Per Coin (Grams) : 0.015 gm

This schedule of events is merely a projection of future coin releases: depending on demand and supply and is subject to change at any time. Deviations from this schedule will be accompanied by an official announcement to the public. Furthermore, the total supply of SGC coins in existence will not at any point in time exceed one billion SGC coins.

SGC COIN SALE

- Join at: sale.securedgoldcoin.com

- Contact ID: sale@securedgoldcoin.com

- SGC Sale Start Date: October 04th, 2019

- Special Offer End Date: October 14th, 2019

- SGC Sale Supply: 1 Million

- Coin Price: 1 US Dollar

- Currencies Accepted: BTC, ETH, USD

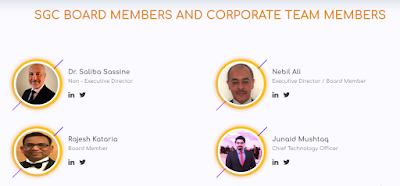

SGC FOUNDERS

Qazi Ahmad Mukhtar

Founder and CEO

Alvia Wang

Co-Founder, Chief Operations Officer

The part of quality and quantity

To to be able to reach a larger market — both cryptocurrency and gold investors, it is necessary for Secured Gold Coin as a platform to employ the services of expert digital marketers and influencers to drive traffic to their social media channels while creating an engaging online community.

Featuring the platform in top media publications like Forbes, Yahoo Finance, CCN, CoinTelegraph, Investing.com, and Hackernoon which have a large reader-base could prove invaluable in bringing Secured Gold Coin to the attention of potential investors.

Also, the inclusion of more incentivized community activities directed towards increasing the online presence of Secured Gold Coin would serve to further increase the project’s online visibility.

Realizing that all great things take time, I believe that in the nearest future, Secured Gold Coin will become one of the most preferred means of investing in the highly liquid and profitable gold markets.

As an investor, I would always seek to use more transparent platforms that are dedicated to improving their brand through partnerships, security audits, and regular community updates.

I had to take my time to outline the differences to inform individuals interested in investing in gold via cryptocurrency realize that although platforms similar to Secured Gold Coin exist, Secured Gold Coin offers numerous advantages over existing alternatives.

WEBSITE – https://www.securedgoldcoin.com/

TWITTER – https://twitter.com/SGC___official

FACEBOOK – https://www.facebook.com/sgccoinofficial

LINKEDIN – https://www.linkedin.com/company/sgc-official-secured-gold-coin/

TELEGRAM – https://t.me/securedgoldcoin_SGC

MEDIUM – https://medium.com/@SGC_official

WHITEPAPER – https://www.securedgoldcoin.com/file/SGC_Whitepaper_V_1.0.1.pdf

ONE PAGER – https://www.securedgoldcoin.com/file/SGC_Onepager_V_1.0.0.pdf

Profile : https://bitcointalk.org/index.php?action=profile;u=2103066

SGC Wallet Address : 0x41C23D9c552276a6a795d6630F63F6C1c4a6d51A

No comments:

Post a Comment