Hello everyone, If you are interested in joining the Viva project, it is a good idea to read reviews that can help you get information that might help you in viewing their mission vision:

Viva is a transformative financial technology that introduces large-scale decentralized mortgage financing to the world. Viva’s platform will utilize smart contracts to crowdfund home loans, connecting borrowers and investors directly within a decentralized, trustless ecosystem. By leveraging ultra-secure blockchain transactions, Viva cuts out the middlemen, resulting in a lending process that is more profitable and efficient for all parties.

Viva enables a free market to determine the rate of interest on a borrower’s mortgage and removes the need for banks and other financial intermediaries. By eliminating inefficiencies in local financial systems, mortgage rates will more fairly and accurately reflect the level of risk associated with the asset’s true value. The failure of the banking system in 2008 yielded the world’s first ever cryptocurrency and began the process of decentralizing the power held by financial conglomerates. Viva intends to finish the job – by leaving the inefficient, centuries-old financing system where it truly belongs: in the past.

Vision

We believe that the most effective solution for global economic wealth disparity is the advancement of technology. Blockchain technology is an innovation that has already proven its ability to decentralize and disrupt some of the largest industries in the world. Viva aims to revolutionize the antiquated mortgage lending industry by cutting out the middlemen and decentralizing the process, thereby applying a fundamentally more accessible and transparent approach to financing. We believe that Viva’s technology will increase the availability of credit for borrowers and for the first time allow non-institutional investors to participate in the consistent, asset-backed returns associated with mortgage investments, a product that has traditionally been reserved solely for large financial

institutions.

Furthermore, by allowing the free market to dictate the risk and associated value of each mortgage - as opposed to a bank - we expect to see more fairly priced mortgages. The Viva platform will be leveraged by those in the developed and developing worlds alike, thereby enabling the world to take a large step toward geographical wealth equality - by breaking down the barriers and leaving both parties better off.

Mission

Our mission is to disrupt the mortgage industry by allowing home buyers and sellers to set the terms themselves. Any individual, from any country in the world, will have access to credit financing for home loans via a decentralized, open market network on the Viva Platform.

Additionally, Viva’s function as an investment and savings platform accessible with just a mobile phone means all users of Viva will have access to credit financing, a savings and investment account, and standard blockchain-backed secure transaction services - regardless of what country they live in.

How Does Viva Work?

Viva allows buyers to earn low interest rates & investors to get higher yields.

VIVA IS Financial Inclusion

What is financial inclusion?

A financial system where individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way. A lack of financial inclusion is the single greatest barrier holding back residents of third world countries from advancing in the global economy. A large portion of the world’s population does not have access to financial systems that are financially inclusive which perpetuates economic inequality.

In many cases, highly credit-worthy individuals who live in these countries get unfavorably grouped together in the bank’s credit collection rate algorithms, and are required to pay unreasonably high interest rates relative to the risk associated with their creditworthiness. Financial inclusion opens up opportunities for economic advancement that perhaps no other intervention can, and has a significant impact on a family unit’s ability to grow wealth and pass on inheritance.

One of the core tenets of blockchain technology is a leveling of existing playing fields to create a fair, transparent and secure decentralized-market for all to use. Viva’s technology has been a dream of blockchain visionaries since the inception of Bitcoin, and it is now on the verge of becoming a reality. Viva can open possibilities for millions of people in the world who have been subjected to unfair credit evaluation based on their geographic location, by entitling all of its

users to the four pillars of financial inclusion.

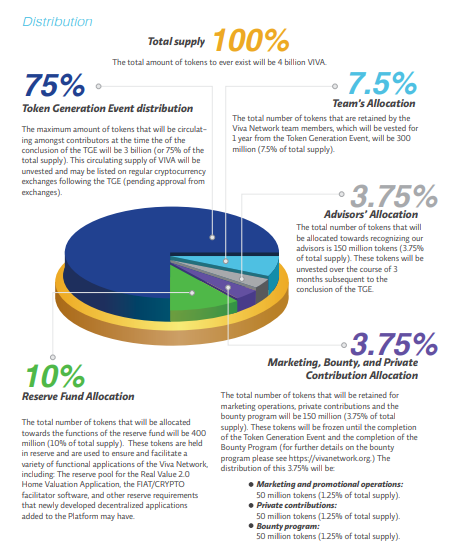

Token distribution

1. To participate in the token sale, participants must visit https://vivanetwork.org.

2. The only accepted contribution for the Token Generation Event is Ethereum (all other digital currencies [cryptocurrencies] sent to the address provided will result in a loss of that currency.)

3. Participants must send Ethereum from the address which they want to receive the VIVA tokens. This cannot be from an exchange. All Ethereum sent from an exchange will result in the loss of your VIVA tokens.

4. If there are any undistributed VIVA tokens at the conclusion of the Token Generation Event, they will automatically be burned via the smart contract system.

5. The hard cap for the Early Contribution Period is 6,870 ETH. The contributions resulting from the Token Generation Event will assist The Viva Network with the development, marketing, promotion, and other efforts that are

intended to quickly add value to the project and promote the Token Generation Event (ie. Legal advisory fees, costs associated with patents, marketing, MVP production, and further product development.)

6. The hard cap for the Main Contribution Period is: 68,770 ETH.

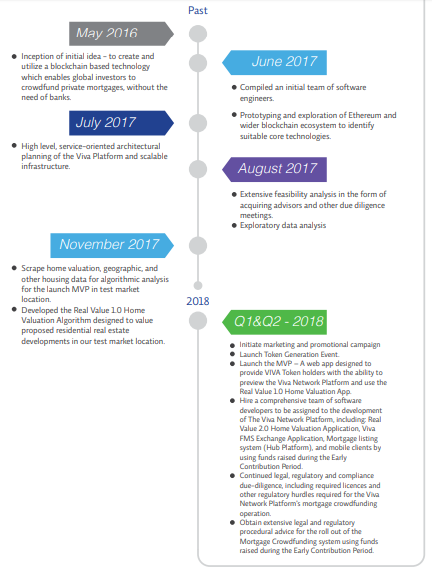

Roadmap

You can find out more about the platform or participate in their sales crowd through the following links:

- WEBSITE: http://www.vivanetwork.org/

- WHITEPAPER: http://www.vivanetwork.org/pdf/whitepaper.pdf

- FACEBOOK : https://www.facebook.com/VivaNetworkOfficial/

- TWITTER: https://twitter.com/TheVivaNetwork

- TELEGRAM: http://t.me/Wearethevivanetwork

Username : Ozie94

ETH : 0xDa2F65ea0ED1948576694e44b54637ebeCA22576

No comments:

Post a Comment