Hello friends, here I will discuss about Paygine Project or a quality future platform designed to operate within its own proprietary banking structure and this project is created by a reliable propesional Team in handling all your needs to start the Crypto business.

Paygine is an open financial platform designed to serve FinTech and crypto business needs in the areas of remittances, currency exchange, and payments for "real" goods and services under the White Label solution.

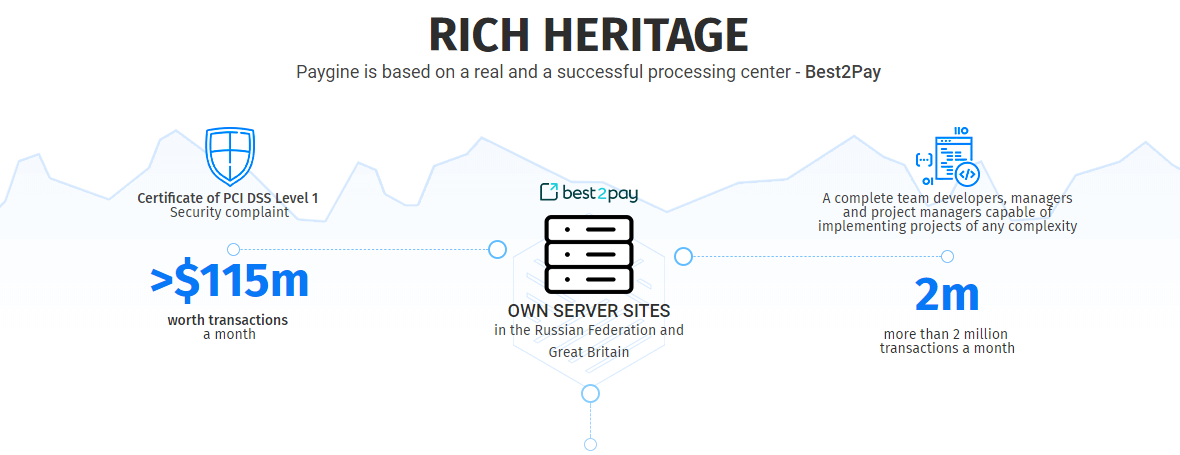

Based on the needs of international banks and financial organizations, the founders of Best2Pay decided to create a new platform united by a single IT system with an open API. Paygine’s key competitive advantage over similar projects is that it can leverage off existing Best2Pay services and technologies currently used by FinTech businesses, e-commerce, and beyond.

The Paygine platform would offer the following services by utilizing Best2Pay existing technology:

- Transferring cryptocurrency to/from a bank card;

- Paying in shops and stores using a card in cryptocurrency;

- Accepting cryptocurrency as a payment for goods and services at online stores;

- Carrying out cross-border transfers of fiat currencies by means of cryptocurrency with minimal costs;

- Maintaining wallets in both fiat currencies and cryptocurrencies with the ability to conveniently and quickly convert funds between them.

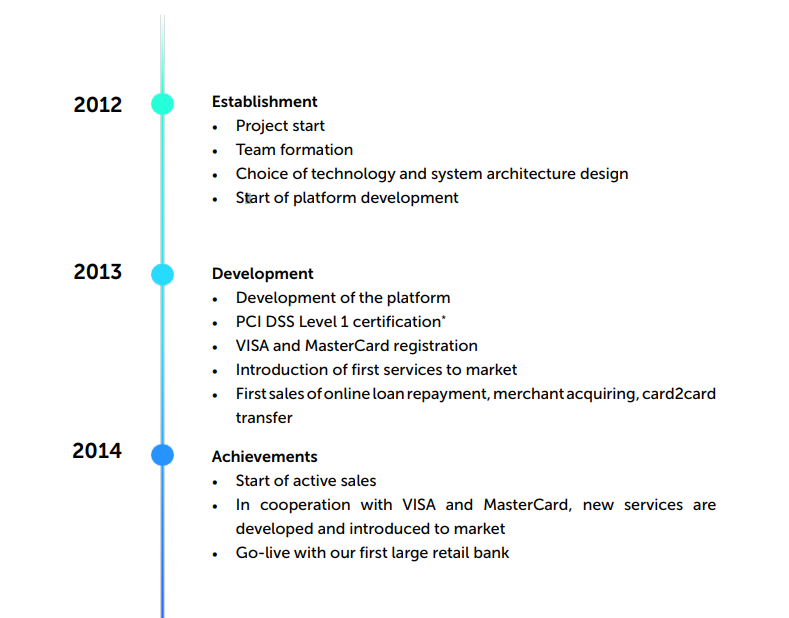

Best2Pay and was founded in the UK in 2012 by experts from the banking sector with experience in implementing projects in American Express, SEB, Raiffeisenbank, Bank St. Petersburg, Russian Standard Bank and Sberbank.

Best2Pay services uses projects from the field of fintech and e-commerce to serve more than 1.5 million customers, whose number is growing by 34% monthly.

Best2Pay platform allows to implement a project of any complexity, which will take into account the unique features of business processes, infrastructure and client's target client audience..

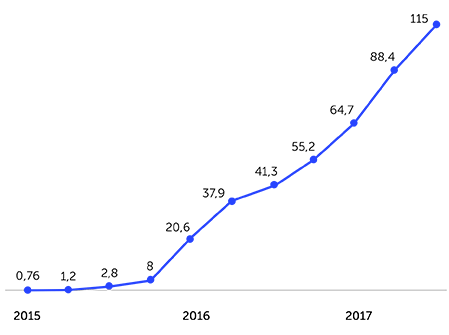

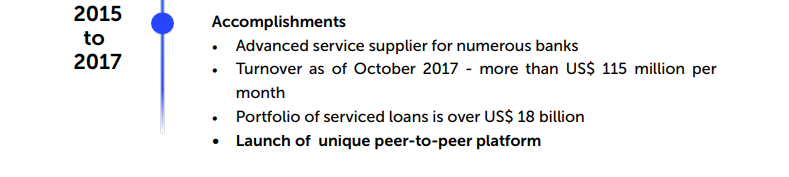

BEST2PAY – MARKET LEADER FOR ONLINE RE-PAYMENT OF LOANS AND PEER2PEER TRANSFERS

Best2Pay’s Revenue per month, repayment of loans and peer-2-peer transfers for 2015-2017 (USD)

We came up with the idea to build an open financial platform that includes own banks (banks owned by platform founders) in 2017. At that time, we, together with our partners, were launching a bitcoin-based remittance system for money transfers from the US to Mexico. We have developed an IT-system, resolved all legal issues with the assistance of lawyers, and obtained a legal opinion that confirmed the legality of our operations and actions.

It seemed that only one small thing was lacking — to find banks that were ready to cooperate — and there our problems began. As soon as they learned we were going to use Bitcoin as a payment method, banks would immediately refuse to service us, despite all the documents and legal opinions provided. We faced the same problem when we tried to set up a last-mile remittance service in Europe. All solutions were way too complex — with a multitude of intermediaries — and did not guarantee to operate stably for more than 1 or 2 months, even given that, in addition to having the legal opinion, we complied with all AML/KYC requirements. But this was no help. Banks and financial institutions simply refused to work with us when they heard “bitcoin”, for no real reason at all!

The second problem we faced in the United States and Europe was that even if some financial institutions would not stop negotiating after hearing “bitcoin”, it turned out they simply did not have any white label options and could not provide us with all services we needed through APIs. This resulted in our clients having to contact directly our partners, submit a whole lot of documents, use their interface, etc.

As we found out later, more than 79% of FinTech startups and crypto-related CME are struggling with these two problems. Currently, according to different estimates, the total cryptocurrency market cap has exceeded several hundreds billion US dollars — and most of that money is not available to the real economy sector or to real people in their everyday lives!

That is exactly why we decided to offer something fundamentally new to the market.

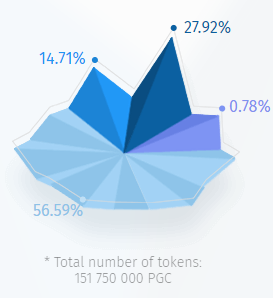

DISTRIBUTION OF TOKENS

and projected use of income

Name and logo of the token:PGC

Price:1.00 PGC = 1.00 USD

Blockchain:Ethereum, ERC20

Using the token:After the launch of the project, each holder will have the right to pay for goods or services using tokens in the ratio 1 PGC = 1 USD.

All unsold tokens will be sent to thereserve for use on the Paygine platform in the future.

Tokens distributed among the investors of the project will be

41 508 000 PGC (27.92%)

Tokens distributed among the project team members will be

22 500 000 PGC (14.71%)

Tokens allocated to the reserve will be

87 742 392 PGC (56.59%)

Tokens retired to the bounty will be

1 191 608 PGC (0.78%)

Scheme of the Funds Distribution:

- Buying the bank (64.9%)

- Staff (18.3%)

- Legal expenses (registration, license, consultations) (4.8%)

- Operational expenses (0.3%)

- Lease (1.3%)

- Buying software and its setting (10.3%)

Watch a video about token

WEBSITE:https://www.paygine.com/

WHITEPAPER:https://www.paygine.com/assets/helpers/files/en.pdf

TELEGRAM:https://t.me/paygine_official

FACEBOOK:https://www.facebook.com/paygine/

TWITTER:https://twitter.com/paygine

Username : Ozie94

ETH : 0xDa2F65ea0ED1948576694e44b54637ebeCA22576

No comments:

Post a Comment