Hallo ... If you are interested in joining the Blockonomics project or you are interested in joining the Blockonomics project, it is a good idea to read reviews that can help you get information that might help you in viewing their mission vision during the Blockonomics project.

Mission Statement

Blockonomics is an industry-leading payment processing system for merchants accepting Bitcoin. Our aim is to provide our users truly decentralized, trusted and secure, completely permissionless, straight to wallet Bitcoin payment solutions. We view ourselves as strong believers of decentralization and cryptography.

The Future Growth of E-commerce

To begin, a simply-put explanation of the notion of E-commerce is critical. Essentially, Ecommerce, or more precisely electronic commerce, is the purchasing and selling of goods or services on the Internet.

E-commerce is not a new phenomenon. Actually, its history dates back further about 40 years ago, when CompuServe was founded by electrical engineer students Dr. John R. Goltz and Jeffry Wilkins in 1969, utilizing a dial-up connection. In the 1980s, CompuServe introduced some of the earliest forms of email and internet connectivity to the public and went on dominate the E-commerce landscape through the mid-1990s. In 1994, Jeff Bezos founded Amazon as an online store selling over one million different books in its earliest days. Amazon would eventually become the most popular online store for customers to purchase any type of products. When PayPal was founded in December 1998, the shopping experience for customers was simplified as credit cards were easily accepted in markets across the world. Since then, E-commerce has assisted countless businesses to grow with technology, internet connectivity improvements, and customer adoption.

The history of E-commerce growth has been impressive. However, its expected growth seems to be by far more fascinating. Below some key statistics and international global Ecommerce growth trends are presented:

• By 2021, global retail E-commerce sales will reach $4.5 Trillion According to Statista, E-commerce sales will increase worldwide from $1.3 trillion in 2014 to $4.5 trillion in 2021.

The Future Growth of E-commerce

• Customer experience and personalization

Today’s information overload makes customers evaluate their time differently. They have a desire to avoid wasting their time with irrelevant information. Businesses that provide personalized services, product and information will stand out from the crowd and succeed in customer loyalty. According to a report by Boston Consulting Group, retailers that have used personalization strategies see sales gains of 6-10% at a rate two to three times faster than other retailers.

• Global B2B E-commerce sales dominate B2C E-commerce

B2C E-commerce encompasses transactions made between a business and a consumer, while B2B E-commerce relates to sales made between businesses, such as a manufacturer and a wholesaler or a retailer.

In 2017, B2C E-commerce sales hit $2.3 trillion worldwide, while B2B E-commerce reached $7.7 trillion, noticing a 234.78% difference in market size.

• Multi-platform & multi-device

By the end of 2017, two billion people have used their mobile devices to shop online. Additionally, some 85% of online shoppers have started a purchase on one device and finish on another, meaning that integrating online platforms and devices will be the key to further E-commerce success. Businesses will need to adopt an omni channel strategy to thrive and a solid back-end to connect clients to their brands.

• M-commerce

Mobile will reach 70% of e-commerce traffic by the end of 2018. Furthermore, according to Goldman Sachs forecasts, mobile commerce in 2018 will equal the total E-commerce revenue of 2013. Technological advancements are able to make mobile checkout the preferred method of payment for many customers.

• Voiceh searc

Millennials more often are using voice assistance in searching for products online - 40% of whom have already used the service. By 2020, the number will surpass 50%. This is apparently a hot topic for search engineers and advertisers - businesses need to elaborate the optimizing method of their listings for voice search and ensuring that their content is

relevant.

relevant.

• Emerging market potential

The E-commerce markets have started to mature around the world. According to Business Insider, India, Southeast Asia and Latin America are countries where E-commerce penetration rates are only around 2 to 6%, making them a potential goldmine for growth. Additionally, these regions are expected to grow at compounded annual growth rates of 31%, 32%, and 16% respectively through 2021.

The Future Growth of E-commerce

• The growth of E-commerce powers the growth of online payments, and vice versa.

Technology, on the other hand, has reshaped commerce and has driven payments options. Besides technology, the entry of non-traditional players in the market, higher demand of customer expectations, and “enabling regulations” appear to be the four seismic shifts in the global landscape. The total value of global retail payment transactions was at $16 trillion USD in 2015. This is estimated to increase to $21 trillion USD by 2020, which is comprised of consumer-to -merchant transactions across retail verticals such as food and grocery, apparel, consumer durables, etc. Digital payments contributed to 8 percent of the overall global retail payments in 2015, and the same is projected to increase

to 18-24 percent by 2020.

Technology gave the inevitable birth to cryptocurrencies, which aspire to become a means of transacting through its digital form. Many reputable E-commerce stores have already included cryptocurrency payment options, and the number is growing each week. The major pros of including cryptocurrencies could refer to reduced fraud as cryptocurrency payments are irreversible, lower (or non-existent) transaction fees, and greater customer reach. Consumers and merchants alike have been in favor of Bitcoin due to its anonymous nature.

Since 2015, Blockonomics has helped thousands of E-commerce sites increase sales by including Bitcoin, Ethereum, Litecoin and other major altcoins as a payment option for their customers.

Security, safety, and convenience are among the major advantages of the service.

Furthermore, no need for exchanges and middlemen exists since coins go directly into customer’s wallet, eliminating chargebacks and fraud.

The Future Growth of E-commerce

• The growth of E-commerce powers the growth of online payments, and vice versa.

Technology, on the other hand, has reshaped commerce and has driven payments options. Besides technology, the entry of non-traditional players in the market, higher demand of customer expectations, and “enabling regulations” appear to be the four seismic shifts in the global landscape. The total value of global retail payment transactions was at $16 trillion USD in 2015. This is estimated to increase to $21 trillion USD by 2020, which is comprised of consumer-to-merchant transactions across retail verticals such as food and grocery, apparel, consumer durables, etc. Digital payments contributed to 8 percent of the overall global retail payments in 2015, and the same is projected to increase

to 18-24 percent by 2020.

Technology gave the inevitable birth to cryptocurrencies, which aspire to become a means of transacting through its digital form. Many reputable E-commerce stores have already included cryptocurrency payment options, and the number is growing each week. The major pros of including cryptocurrencies could refer to reduced fraud as cryptocurrency payments are irreversible, lower (or non-existent) transaction fees, and greater customer

reach. Consumers and merchants alike have been in favor of Bitcoin due to its anonymous nature.

Since 2015, Blockonomics has helped thousands of E-commerce sites increase sales by including Bitcoin, Ethereum, Litecoin and other major altcoins as a payment option for their customers.

Technology, on the other hand, has reshaped commerce and has driven payments options. Besides technology, the entry of non-traditional players in the market, higher demand of customer expectations, and “enabling regulations” appear to be the four seismic shifts in the global landscape. The total value of global retail payment transactions was at $16 trillion USD in 2015. This is estimated to increase to $21 trillion USD by 2020, which is comprised of consumer-to-merchant transactions across retail verticals such as food and grocery, apparel, consumer durables, etc. Digital payments contributed to 8 percent of the overall global retail payments in 2015, and the same is projected to increase

to 18-24 percent by 2020.

Technology gave the inevitable birth to cryptocurrencies, which aspire to become a means of transacting through its digital form. Many reputable E-commerce stores have already included cryptocurrency payment options, and the number is growing each week. The major pros of including cryptocurrencies could refer to reduced fraud as cryptocurrency payments are irreversible, lower (or non-existent) transaction fees, and greater customer

reach. Consumers and merchants alike have been in favor of Bitcoin due to its anonymous nature.

Since 2015, Blockonomics has helped thousands of E-commerce sites increase sales by including Bitcoin, Ethereum, Litecoin and other major altcoins as a payment option for their customers.

Security, safety, and convenience are among the major advantages of the service.

Furthermore, no need for exchanges and middlemen exists since coins go directly into customer’s wallet, eliminating chargebacks and fraud.

The Current State of Bitcoin, E-commerce and Online Payments

"Bitcoin is well suited for online transactions. It has no transaction fees and works well for international customers. Providing this convenience for the cult-following Bitcoin customer is the smart thing to do.”

- Patrick M. Byrne, Overstock.com, Chairman and CEO

E-commerce is driven by a wide range of payment methods that best suit the diverse preferences of consumers, the options that define each transaction, and the general attributes of the product or service. However, the commonality of these methods is the existence of a trusted third party gateway, which handles the facilitation of payment within the transaction. Until recently, there a widely-available equivalent to cash in E-commerce did not exist, even though the need for a sort of electronic money was obvious - especially in the areas of micropayments. This inefficiency was highlighted in 2008 by Satoshi Nakamoto (a pseudonym for an individual or group of programmers) in a white paper

entitled “Bitcoin: A Peer-to-Peer Electronic Cash System”. The paper suggested a mechanism based on peer-to-peer networking, through which a payment system could eliminate financial intermediaries and allow users to make direct and relatively anonymous transactions via the Internet (Polasik et al., 2015).

The Current State of Bitcoin, E-commerce and Online Payments

As Bitcoin becomes more ubiquitous, merchant interest has grown rapidly in the world’s #1 cryptocurrency as a payment method. There are countless reasons for the spike in interest:

• Reduced fraud: Due to the write-once nature of the distributed ledger, the cryptocurrency transaction is irreversible. As a result, the customer cannot initiate a chargeback. However, legitimate refunds can still be issued as a new transaction back to the customer.

• Border-free Payments: Wherever you have unrestricted Internet, cryptocurrencies are available. Accepting payments internationally is identical to regional and local payments.

• No PCI Concerns: Unlike credit cards numbers, Bitcoin account addresses are public by nature. However, a transaction cannot be executed without a private key only known to the wallet owner. In a standard transaction, the merchant provides a receiving address and the consumer issues a payment to it.

• Lower Fees: A small fraction of each cryptocurrency transaction paid by the sender is paid back to the network. E-commerce merchants typically pay a small fee to the payment gateway, however these charges are remarkably less than those of PayPal and other credit cards services, and as crypto becomes more widespread, these fees are expected to lower to create competition in the processing marketplace.

• Privacy: With the General Data Protection Regulation (GDPR) in the EU and the recent fallout from Facebook in the United States, customers are more sensitive to their privacy. While Bitcoin is not truly anonymous, it enables buyers to send payments without the need for billing information.

All these advantages have led numerous major retailers to start accepting Bitcoin. There are numerous examples of the tremendous penetration of Bitcoin in the E-commerce industry.

• Overstock.com: The first big online retailer to start accepting Bitcoins. In January 2014, Overstock.com allowed its customers to purchase everything with them, or other cryptocurrencies such as Ethereum, Litecoin, Dash, Monero and Bitcoin Cash.

• Expedia: One of the largest online travel booking agencies worldwide. Since June of 2014, users have had the option to pay for their hotel bookings and vacations with Bitcoin.

• eGifter: eGifter is a popular gift card site and mobile app that lets users buy gift cards for all sorts of places, including Amazon, JCPenny, Sephora and more.

• Shopify: One of the world’s top E-commerce platforms allows shops to sell their products similar to Etsy or eBay. In November of 2013, all 75,000+ Shopify merchants received the option to start accepting Bitcoin payments.

The Current State of Bitcoin, E-commerce and Online Payments

However, some merchants are still skeptical regarding the adoption of Bitcoin as a payment method. Below are the more fundamental explanations of this attitude:

• Scalability: Despite cryptocurrency’s growing user base and hype, most distributed ledger networks are still in its infancy. Even Bitcoin, the first and most popular cryptocurrency, can only reasonably process a handful of transactions per second - a far cry away from services such as Visa that handle 2,000+ transactions per second. However, scaling solutions are in progress and alternative ledger designs are built for speed, including the Lightning Network.

• Price Volatility: Bitcoin is a new asset class with growing user base, but a fair market value is difficult to be understood. Combining this with an unregulated marketplace that consists of novice investors, the results lead to significant price volatility. As the relationship between Bitcoin and E-commerce evolves, the primary market driver will stabilize as it shifts from investment-focused holders, to the buying and selling of Bitcoin.

• Customer Service: With a more steep learning curve for buyers, supporting an additional payment option in checkout can create complex and confusing customer inquiries. Educational material is needed both to consumers and to merchants to simplify the process.

The value of Bitcoin in the field of E-commerce and online payments is promising, after all. Whether the ease of money transfer, less paperwork involvement, highly secure, the efficiency of currency type transfer from one to another, or other abovementioned benefits over traditional money transfers; digital currencies like Bitcoin are helping both private users and online merchants to experience a whole new world of monetary exchange with complete ease.

Paving the path for a brighter future, Blockonomics, one of the top Bitcoin payment processors, has provided tools and infrastructure to merchants to help accept cryptocurrencies with ease and hassle-free.

To extend use cases for Bitcoin, Blockonomics also allows for wallet monitoring and email notifications for anyone holding a Bitcoin wallet. With E-commerce plugins and payment buttons available, Blockonomics makes it easier for the everyday merchant to accept Bitcoin.

Current Problems that Merchants and Customers Face in Using Bitcoin in E-commerce

As relatively new technology in the E-commerce space, there are major issues that online merchants and their customers are facing in using Bitcoin in E-commerce sales.

Many E-commerce store owners have a desire to offer customers as many payment options as possible. While this may mean increased conversions and sales, it does increase risk for fraudulent payments. As Bitcoin and cryptocurrencies, in general, are moving towards mainstream adoption, large organizations, including Amazon have discussed offering the cryptocurrency payments as a payment option. However, a high percentage of online retailers and other trading

platforms are still unwilling to accept Bitcoin payments.

A recent study, cited by oracletimes.com revealed that of the top 500 online retailers, only three of them accepted Bitcoin payments, a decrease from the previous year’s five.

Below are the most frequented reasons why online retailers and customers are still reluctant to adopt Bitcoin payments even after its nine years of growth.

• Bitcoin and cryptocurrency price volatility

Considered the most significant problem with Bitcoin is volatile of its value relative to fiat currencies such as dollars or euros. Let’s present the possible revenue loss for a merchant due to Bitcoin’s price fluctuation. When we purchase a $1,000 basket of goods in the morning, but by evening the value of Bitcoin has decreased, and the value of the Bitcoin that was paid is now $900. The difference of $100 is a revenue loss for the retailer. A loss for a big retailer like Amazon that produces thousands of sales every day, that $100 could add up to millions of dollars of losses every month. Consequently, Bitcoin and other cryptocurrencies price volatility could lead to unquantifiable risk for online retailers.

However, there is a solution for this: a payment processor can provides the option of receiving all payments in the fiat currency of the customer’s choice, and instantly convert the payment to euros at the time of the transaction. As a result, the customers will always receive the exact euro amount that his / her product was priced at, removing the volatility

risk for merchants accepting Bitcoin.

The high costs of Bitcoin transactions

In 2017, a period that Bitcoin transaction fees were relatively high, an Australian Ecommerce consultant, Alex Levashov, conducted a thorough comparison between the exact cost of transacting in Bitcoin and PayPal. According to him, PayPal charges are a fixed percentage of the amount transacted, while corresponding Bitcoin’s charges are differently calculated and are dependent on several facts besides the amount of money being transferred. Levashov calculations revealed that the average cost per transaction made through PayPal was $2, while Bitcoin’s was $14. Additionally, with traditional electronic transactions systems like PayPal, the cost of low transaction fees incurred can burden the retailer.

Current Problems that Merchants and Customers Face in Using Bitcoin in E-commerce

Nevertheless, if the transaction fees incurred when transacting in Bitcoin are handled by the customer, increasing the overall cost to every purchase - many merchants have avoided this payment method to keep from upsetting their customers. However, the Bitcoin transactions fees have substantially decreased since the time of the above mentioned survey. On March 25, 2018, Bitcoin transaction fees were at a major low, making it the cheapest time in nearly 12 months to send Bitcoin. As a result, lower fees means wider adoption and more merchants and customers to take part in it.

Bitcoin as store-of-value

Many Bitcoin investors consider it and other cryptocurrencies more of an asset than a currency, due to the increased profitability of crypto trading. Fiat currencies show limited value change over the years. On the other hand, Bitcoin’s value is constantly changing, meaning that holders can hit excessive gains by trading their coins. As a result, many online retailers’ customers are reluctant to use their cryptocoins to make purchases instead of trading. This reluctance can lead to making Bitcoin payments fall below the break even point, as the the minimum number of transactions needed for the retailers to profit from adopting Bitcoin payments. As the market and the investors mature and Bitcoin price stabilize, consumers become more willing to spend their Bitcoins in purchasing deals, urging merchants to reconsider their options. It is apparent that there’s a solution for every problem. The same occurs for the challenges in

using of Bitcoin and other cryptocurrencies in the E-commerce. The adoption of cryptocurrencies in E-commerce is expected to follow the trend of Bitcoin’s adoption. History has taught us that the initial reluctance to use Bitcoin has been replaced by mass adoption and acceptance. As each day passes, more and more online customers will spend their

cryptocurrencies in online purchases, making the availability of crypto payments a definite option in modern E-commerce services.

All these make online stores and websites to look at the Bitcoin payment solutions. One decentralized and permissionless solution is Blockonomics. Our services let merchants accept Bitcoin payments on their store or website with ease. There are no security risks and payments go directly into merchant’s Bitcoin wallet. The complete checkout process occurs within the merchant’s website and customers never leave the store. Furthermore, all major HD wallets and fiat currencies are supported. Additionally, no approvals of API key are required and installation is fast and simple. Last but not least, there is a low 1% fee on payments, with the first ten transactions free of charge.

To sum up, it is a fact that successful online stores are constantly looking for ways to improve customer service and payment options availability. Adding Bitcoin payment option as a new payment solution will definitely increase sales figures, recognition and customer satisfaction.

As we continuously state:

“Bypass the massive credit card transaction fees. Control your money and ‘be your own bank’.”

using of Bitcoin and other cryptocurrencies in the E-commerce. The adoption of cryptocurrencies in E-commerce is expected to follow the trend of Bitcoin’s adoption. History has taught us that the initial reluctance to use Bitcoin has been replaced by mass adoption and acceptance. As each day passes, more and more online customers will spend their

cryptocurrencies in online purchases, making the availability of crypto payments a definite option in modern E-commerce services.

All these make online stores and websites to look at the Bitcoin payment solutions. One decentralized and permissionless solution is Blockonomics. Our services let merchants accept Bitcoin payments on their store or website with ease. There are no security risks and payments go directly into merchant’s Bitcoin wallet. The complete checkout process occurs within the merchant’s website and customers never leave the store. Furthermore, all major HD wallets and fiat currencies are supported. Additionally, no approvals of API key are required and installation is fast and simple. Last but not least, there is a low 1% fee on payments, with the first ten transactions free of charge.

To sum up, it is a fact that successful online stores are constantly looking for ways to improve customer service and payment options availability. Adding Bitcoin payment option as a new payment solution will definitely increase sales figures, recognition and customer satisfaction.

As we continuously state:

“Bypass the massive credit card transaction fees. Control your money and ‘be your own bank’.”

The Benefits of Bitcoin as a Payment Option Over Credit Cards, PayPal, etc.

Cryptocurrency is a medium for making and receiving payments over a network using digital bits and encryption. Its success within electronic commerce is remarkable due to the elimination of the infrastructure; and is associated with storing physical money costs, the transferring of funds between financial institutions among different countries, and eliminating online credit card fraud among others. There are many unique benefits of using Bitcoin as a payment option over credit cards, PayPal, and other methods.

Bitcoin is an invention with a fascinating history and promising future. Bitcoin’s decentralized public ledger, namely blockchain, establishes instant trust between parties with no prior knowledge of each other. This virtual currency that works on a peer-to-peer network offers a lot of benefits compared to using credit cards.

• Freedom in payments

There is no restriction on the amount of money sent globally and instantly. Users do not need to be over 18, or live in a developed economy, have a regular income, or even have an ID.

Bitcoin user does not need to worry about bank holidays or the timelines of banking services.

Payments go through under any circumstances and users are always in control of their digital money. These functions can actually let the user “be their own bank”, or “have a bank in his or her pocket” by way of a smartphone. Additionally, it’s extremely simple for anyone to create their own Bitcoin “bank account”, as long as he/she has a computer with access to the Internet. Lastly, users do not have to worry about a bank selling transaction history to a third party, or having their personal data hacked.

• Low transaction fees

Digital currency users enjoy zero or low transaction fees compared to other online payments methods, such as PayPal, Western Union, and credit cards. In fact, Bitcoin fees are significantly low (between 5 to 10 cents of the US dollar), while transactions fees via other methods like credits cards, PayPal, and Western Union in some occasions may reach the level of 9-10% of the transaction. The larger the amount of the transaction processed, the higher the fees deducted proportionately. This is an opportunity for merchants to see their customers embrace Bitcoin as a payment option. Low Bitcoin transaction costs are also important for merchants because it permits them to remove fees they pay to companies like PayPal and Visa. In fact, some online stores notice profit margins of one or two percent due to the high volume of purchased products, and the fact that Bitcoin can remove the 2-3% discount rate charged for accepting credits cards.

The Benefits of Bitcoin as a Payment Option Over Credit Cards, PayPal, etc.

Security

Many PayPal users believe that PayPal is a safe way to pay with a credit card, as it offers an extra layer between themselves and the online merchant, limiting their card details from being stored directly on a merchant’s site. For this to happen, users must provide the receiver with full access to his/her funds, and trust that they will keep this information secure and not to abuse it. However, PayPal and credit cards have become a frequent target of phishing emails, which tricks users to reveal their PayPal account detail. On the other hand, during a Bitcoin transaction, users supply the information necessary to send the amount for that transaction without sharing personal information, as users can only see the public address, which is completely secure. Provided that no sensitive information is contained within Bitcoin transactions, the possibility of fraud on payments or theft of coins is also eliminated.

• No chargebacks

Credit cards chargebacks is a scenario when the buyer disputes the transaction in a case of a defective product or any other possible reason. Merchants are losing a considerable amount of money at the end of each financial year. The irreversibility of Bitcoin transactions allows no chargebacks or returns, unlike credit card dealings. The adoption of Bitcoin as a payment method could save a large amount of money for the merchant, as customers should be extra careful in making sure that the party they are paying is trustworthy.

• Speed

Another significant benefit of using Bitcoin is that Bitcoin transactions are confirmed very quickly, in a matter of seconds or minutes, as opposed to days as with banks. This speedy verification is essential for small and medium businesses, which require a steady cash flow to maintain their operations. A usual process time takes 10-20 minutes from start to finish or up to an hour if the network connectivity is below par. This time is exponentially less than that of credit card transactions or wire transfers, which usually take days to complete.

• Global Access

There are many countries around the globe where PayPal is not supported, among them Iran, Afghanistan, North Korea and Haiti. While PayPal does not deal with these countries due to mostly political reasons, Bitcoin does not discriminate in such ways and all that is required for access is hardware and a data connection. In countries where Coinbase does not yet exist, Localbitcoins does facilitate a Bitcoin economy anywhere in the world.

The Benefits of Bitcoin as a Payment Option Over Credit Cards, PayPal, etc.

Anonymity

Using PayPal to pay for goods means loss of anonymity, as the service requires users to link at least one account before verification. As a result, all transactions are traceable. On the other hand, Bitcoin operates like cash, meaning that after the completion of the transaction, it becomes increasingly difficult to trace back the sender. Anonymity is for some a con, but those concerned about privacy is a real advantage.

All the above indicate the importance of the use of Bitcoin as a payment method both for merchants and consumers over the conventional online payment methods. Being a consumer, you may have made a step closer into the world of Bitcoin.

Being a merchant, this is an opportunity to provide an extra payment option to your customers.

Blockonomics is a decentralized Bitcoin payment solution that provides specialized transactional tools that enhance BTC use. Their service enhances the wallets you already own. The payment lets you accept Bitcoin payments on your WHMCS installation with ease. There are no security risks; payments go directly into your own bitcoin wallet. The complete checkout process happens within your website; customers never leave your site. All major HD wallets are supported, as well as all major fiat currencies. No approvals of API key are required, installation is fast and simple.

About Blockonomics and the ICO

Bitcoin is the remedy for E-commerce offering cheaper transactions fees than conventional payments methods, minimizing fraud and chargebacks, and providing secure Blockchain transactions. Bitcoin payment have risen over 80% since 2014 on E-commerce sites. Moreover, Bitcoin buyers spend more than non-Bitcoin ones. Lastly, borderless Bitcoin allows easier access to a global market.

Looking closer at the platform benefits, Blockonomics guarantees the absolute lack of middlemen, the lack of access to users’ private keys, the lack of KYC/documentation and the direct and instant E-commerce payments and donations to any SegWit or non-SegWit wallet.

To enhance their platform services, Blockonomics have issued BCK tokens. BCK is a utility token that enables support to BCH, LTC, and ETH and Lightning Network integration. Moreover, it sends API with Multi-signature wallets. These tokens provide a variety of perks to customers too. Customers can use BCK tokens to over 2000+ worldwide Blockonomics powered stores, without paying any payment fee for BCK transaction on the platform. In case of E-commerce purchases to Blockonomics powered E-commerce sites, customers alongside Bitcoin will be able to use BCK tokens and receive discounts on the purchased items. Lastly, using BCK token, customers can get bonuses/rewards for transactions.

Blockonomics started as a wallet watcher and blockexplorer in 2015, and has been continuously innovating with the latest in Bitcoin technology. Blockonomics is a decentralized and permissionless Bitcoin payment solution, where our services enhance the functionality of the wallets you already own. Our goal is to continue allowing you to accept Bitcoin directly, whether you're invoicing, receiving donations, or running an e-commerce store. We strongly believe the power of Bitcoin is in decentralization and cryptography.

Blockonomics team having completed a successful circle of activities operating as the first gateway to accept Bitcoin payments for E-commerce servicing hundredths of merchants. This experience guarantees that the project is mature enough to proceed to the next step, an Initial Coin Offering. ICO’s aim is to collect adequate funds to improve its infrastructure and finally offer multiple solutions and technologies to merchants, expanding Bitcoin adoption as a means of payment in general.

Blockonomics requires significant funding to create the appropriate tools for merchants that use cryptocurrencies – the merchant suite, the infrastructure, and the further enhancement that posits Bitcoin as the primary payment solution for E-commerce. Due to scalability issues and the increases in the customer base, the company need to develop all the software required: the “staking/farming” software, the mobile and desktop client software and crypto wallet, user interfaces and apps, network infrastructure and monitoring, integrations with other Blockchains, tooling for writing distributed apps and Smart Contracts, and more.

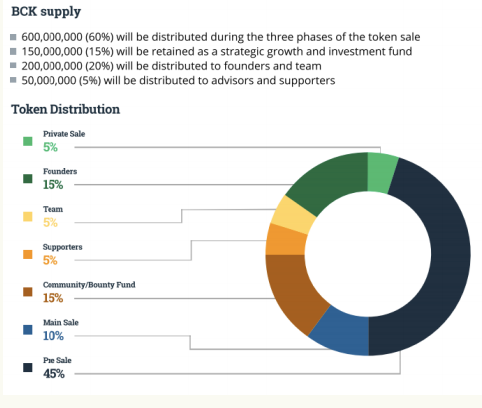

BCK Token Economics

Looking closer at the platform benefits, Blockonomics guarantees the absolute lack of middlemen, the lack of access to users’ private keys, the lack of KYC/documentation and the direct and instant E-commerce payments and donations to any SegWit or non-SegWit wallet.

To enhance their platform services, Blockonomics have issued BCK tokens.

BCK is a utility token that enables support to BCH, LTC, and ETH and Lightning Network integration. Moreover, it sends API with Multi-signature wallet. These tokens provide a variety of perks to customers too.

Key Details about BCK tokens:

Customers can use BCK tokens to over 2000+ worldwide Blockonomics powered sores, without paying any payment fee for BCK transaction on the platform.

In case of E-commerce purchases to Blockonomics powered E-commerce sites, customers alongside Bitcoin will be able to use BCK tokens, availing discounts on the purchased items.

Lastly, using BCK token, customers can get bonuses/rewards on transacting.

In Blockonomics market, the BCK token price will exist in the function of supply and demand.

The total supply is capped at 1,000,000,000 BCK.

Distribution of BCK token:

BCK Token Economics

Distribution of BCK token:

60% of the total BCK supply will be distributed during the three phases of the token sale. 15% of the total BCK supply will be retained as a strategic growth and investment fund. 20% of the total BCK supply will be distributed to founders and team and the rest 5% will be distributed to advisors and supporters.

Hard Cap:

Hard cap for the token sale is capped at $10 million USD for 60% of total supply, effectively incurring the price per 1 BCK of $0.02 USD. Supply is reduced by the BCK tokens held as investments separate to Blockonomics platform merchants and buyers.

The spending of BCK of buyers and the accepting and spending of BCK of merchants will drive demand of BCK.

Blockonomics team having completed a successful circle of activities operating as the first gateway to accept Bitcoin payments for E-commerce servicing hundredths of merchants. This experience guarantees that the project is mature enough to proceed to the next step, an Initial Coin Offering.

ICO’s aim is to collect adequate funds to improve its infrastructure and finally offer multiple solutions and technologies to merchants, expanding Bitcoin adoption as a means of payment in general.

Key Details:

Private Sale

Private Sale phase starts on July 1, 2018, and it ends on July 31, 2018. 45% of the total BCK supply will be allocated including bonuses during the pre-sale phase. The Bonus will be 20%.

The lock-up period for Bonus tokens will last 45 days. The target funds to collect are $7.5 million. $/BCK parity is defined at $0.01666667.

Main Crowdsale

The crowdsale will start on August 1, 2018, and it will end on August 15, 2018. 10% of the total BCK supply will be allocated. The target funds to collect will be $2 million, while the $/BCK parity is defined at $0.02.

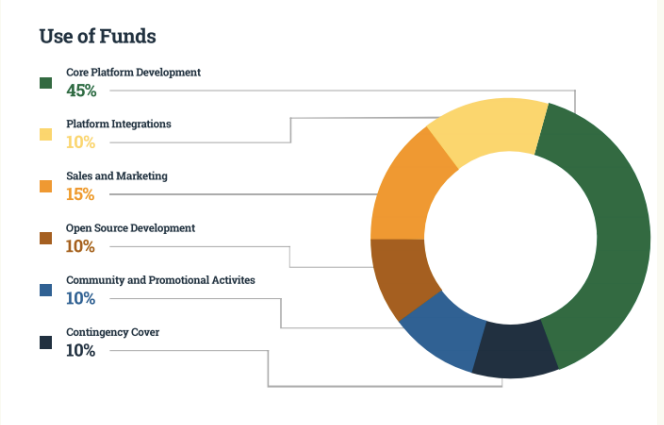

BCK Token Economics

Blockonomics requires significant funding to create the appropriate tools for merchants that use cryptocurrencies – the merchant suite, the infrastructure, and the further enhancement that posits Bitcoin as the primary payment solution for E-commerce. Due to scalability issues and the increases in the customer base, the company need to develop all the software required:

the “staking/farming” software, the mobile and desktop client software and crypto wallet, user interfaces and apps, network infrastructure and monitoring, integrations with other Blockchains, tooling for writing distributed apps and Smart Contracts, and more.

Allocation of funds:

Regarding the funds' allocation: 45% of them will be allocated for the Development of the Core Platform,10% of them will be allocated to Platform Integrations, 15% to Sales and Marketing, 10% to Open Source Development, 10% to Community and Promotional Activities and the rest 10% to Contingency Cover

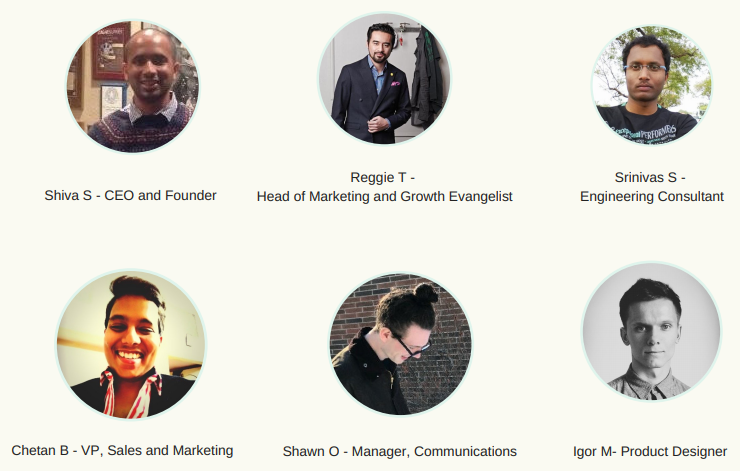

Team

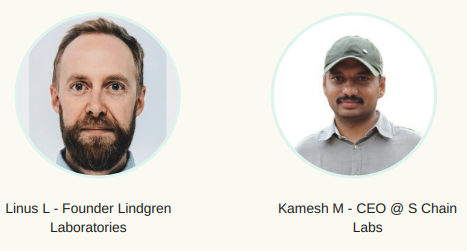

Advisors

Here are the reviews I present to you all in finding information and knowing the Blockonomics project currently being run by their team, if there is a lack of explaining this article, do not worry, I have set up a link for you to get accurate information. information and of course you will be able to talk directly with or their team, at the link.

For more information and joining Blockonomics social media today please follow the following sources:

Ann Thread: https://bitcointalk.org/index.php?topic=4421484

Website: /https://ico.blockonomics.co/

Whitepaper: https://ico.blockonomics.co/docs/Blockonomics_Whitepaper.pdf

Twitter: https://twitter.com/blockonomics_co

Facebook: https://www.facebook.com/Blockonomics-1619324884975855/

Telegram: https://t.me/BlockonomicsICO

Reddit: https://www.reddit.com/r/blockonomics/

Username : Ozie94

Profile : https://bitcointalk.org/index.php?action=profile;u=2103066

ETH : 0xDa2F65ea0ED1948576694e44b54637ebeCA22576

No comments:

Post a Comment